How important is Money to You Nowadays?

Where can We Learn a System on How to Manage our Money?

Money is important to each one of us. We Earn. We Spend. We Save. With money we can provide for our basic needs such as food, shelter, clothing. It also gives us the opportunity to enjoy a Lifestyle we choose to have. We also have the responsibility to save and invest for future needs.

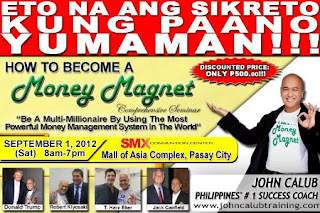

There was this Seminar held by John Calub titled "How to Become a Money Magnet"

A friend wrote an article for me about the said event:

On How to Become a Money Magnet

by Miguel Oscar D. Castelo

As a Financial Advisor, I constantly seek

ways to improve my service to my clients and teach them new things, that’s why

I never get tired of attending seminars and trainings that would help both them

and me.

I started the month of September by

attending a seminar provided by John Calub on how to become a “Money Magnet” by

managing your money well and having the proper mind set to achieve your

financial goals. Obviously I wanted to learn more so that I can teach more, and

paying 500php for knowledge that I would be able to use forever was a cheap

price to pay.

What struck me the most, during the seminar

was the methods and techniques that I have learned as regards to paying

yourself first before you pay for your bills and buy your necessities, a

process that most Filipinos are not familiar with and the main reason why we

always seem to burn through our salaries really fast. Have you ever heard of

the saying “mabilis mawala ang pera”? That was what John Calub was referring

to.

Another aspect of the seminar which caught

my attention was the notion that you will never become rich or financially free

and stable if you just keep your savings in the bank. This is something that I

actually tell my clients about. It is not enough to spend less than what you

earn and put the difference in a savings account, that’s pointless because it

will never grow. You will need to “spend

less than what you earn and invest the difference”. The best part of this

was that one of the safe investment mediums John Calub was talking about is

something that I specialize in which is “Variable Life Insurance” (financial

protection plans packaged with Investments). John told his audience to seek a

Financial Advisor and Life Insurance Agent because they can help kick start

safe investments. You can imagine how much I was trying to restrain myself from

standing up in a crowd of over 1000 people and shouting, “Financial Advisor

right here I specialize in Variable Life Insurance, talk to me after the

seminar”.

All in all, it was a great experience as I

now teach what I have learned to my clients as part of my service. Whether they

get Life Insurance from me as crucial part of their financial planning method

doesn’t really matter, for as long as I see them financially free in the future

because of what I was able to teach them, I would consider myself repaid for my

efforts.

I would like to end this entry with a

question.

When you retire, do you suppose your money

will outlive you? Or will you outlive your money?

If you answered that your money will

outlive you, then congratulations you probably are financially free or at least

on the road to getting there. You are part of the few people who can eat at a

fancy restaurant without the need to look at the right hand column of the menu

(where the price is located). Or you don’t need to charge everything on your

credit card because you’re still waiting on your months’ salary.

But if you answered the latter, and you

feel that what you make won’t be able to support you until the final days of

your life then ask yourself why. Maybe you need to learn how to manage your

money properly.

I find it funny that we spend such a long

time in school to receive a degree in order to get a good job and earn money

but we were never taught how to handle it. For that reason I take pride in my

work as a Financial Advisor, because I teach people something that they do not

actually learn in all their years inside the four corners of the classroom that

cost our parents a small fortune just to put us through school.

I’d like to give a shout out to all my

fellow Filipinos who would like to learn more about how to manage your own

money and make you stop working so hard for the money you earn to the point of

breaking your backs and not enjoying life.

But instead making your money work hard for

you simply because you deserve to become rich while you enjoy the company of

your friends and family as well as enjoying what life has to offer.

I would love to share what I have learned

from this experience as well as what I have learned throughout my career that

would make the financial lives of Filipino people better.

Miguel

Oscar D. Castelo

Pru

Life UK Financial Advisor

For inquiries you may contact Oscar at: 09178039114 or 6711686

PROJECT J.18

No comments:

Post a Comment